Barely more than a week into 2016, Chinese President Xi Jinping is having a rough time of it, with challenges ranging from a tumbling stock market to new provocations from argumentative partner North Korea. While none pose an existential threat to his administration, the world will be watching to see whether he has the sophisticated touch needed to find durable solutions and maintain stability.

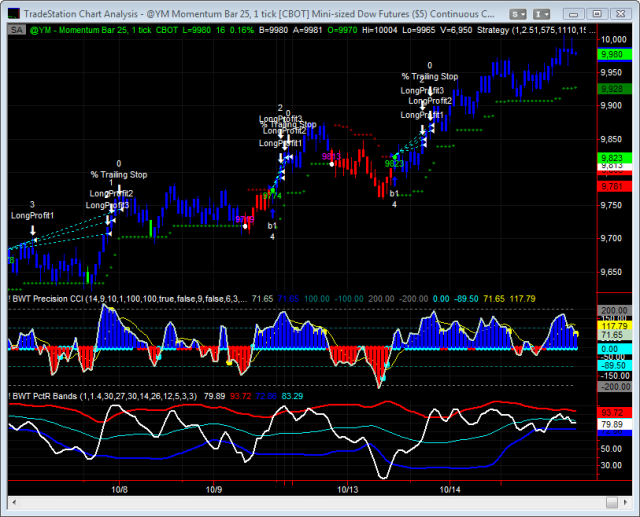

STOCK MARKET VOLATILITY

China twice deployed its “circuit breaker” mechanism to halt trading as stock markets nosedived by 10 percent in the first week of the year. Beijing finally abandoned the mechanism, and left the perception that regulators don’t have a clue as they try to stabilize a market that more than doubled between late 2014 and June, then dived 30 percent, causing deep pain among retail investors.

CURRENCY QUEASINESS

Meanwhile, China’s currency, the yuan, has slid to a five-year low against the dollar, forcing the government to spend tens of millions of dollars from its foreign currency stockpile to defend it. The government last week guided the yuan 1.5 percent lower to assist hard-pressed exporters, but the clumsy move sent shockwaves through world markets, further weighing on Chinese share prices.

SLOWING ECONOMY

Hiccups in the world’s second-largest economy are expected to continue in 2016, with growth falling to a six-year low of 6.9 percent in the July-September quarter and forecast by the International Monetary Fund to decline further to 6.3 percent this year. That bodes ill for the economy’s ability to generate enough new jobs for the more than 7.5 million students due to graduate from college this year, while also building momentum for a transition from an investment-based economy to one focused on services.

NORTH KOREA

Despite persistent calls for restraint, China’s traditional ally North Korea staged what it claims was a hydrogen bomb test blast on Jan. 6 that sent actual tremors across the border into northeastern China and drew condemnation from Beijing. China now finds itself again under pressure to use any possible leverage with the North to tamp down tensions in northeast Asia, while facing the possibility of more robust security cooperation between South Korea and China’s traditional rivals Japan and the United States.

TAIWAN

Voters on the self-governing island democracy appear set to elect a new president whose party opposes Beijing’s goal of unification between the sides. Beijing’s economic inducements have failed to persuade the Taiwanese public of the benefits of political union. If opposition Democratic Progressive Party candidate Tsai Ing-wen wins Saturday, as she is widely expected to do, Beijing may feel compelled to embark on economic and diplomatic pressure that could send relations into reverse. It’s unlikely that Beijing would go so far as to back up its longstanding threat to use force to bring the island under Chinese control. To know more on this, you can always follow us at https://twitter.com/tradinginvestme